Renters Insurance in and around Plano

Plano renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- DFW

- Allen

- Richardson

- Dallas

- Frisco

- McKinney

- Arlington

- Ft Worth

- Lewisville

- Texas

- Houston

- Austin

- Grapevine

- Grand Prairie

- Little Elm

- Prosper

- Irving

- The Colony

- Melissa

- Denton

Home Is Where Your Heart Is

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented house or apartment, renters insurance can be a good idea to protect your possessions, including your video games, coffee maker, stereo, laptop, and more.

Plano renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

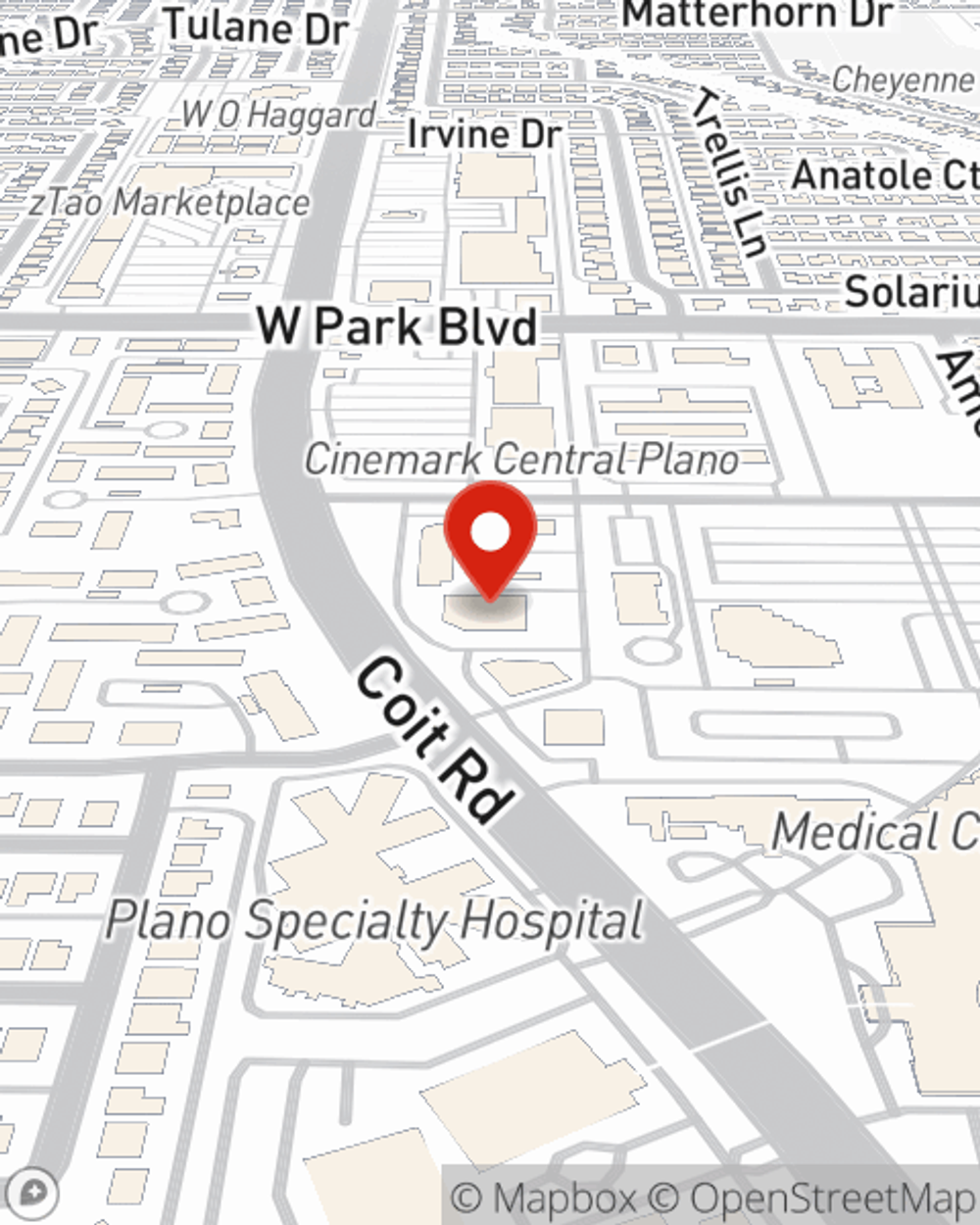

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent Louie Devega can help you generate a plan for when the unanticipated, like a fire or an accident, affects your personal belongings.

There's no better time than the present! Get in touch with Louie Devega's office today to see how helpful renters insurance can be.

Have More Questions About Renters Insurance?

Call Louie at (214) 473-9000 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Louie Devega

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.